Sammons Pensions Recruitment tracks remuneration trends nationwide across in-house, third party, consultancy, and niche specialists, publishing a Salary Survey every year since 2002.

2024 has been another year of exceptional challenge, the ongoing conflict in Ukraine and the Middle East and a change in UK government. Inflation has reduced considerably compared to 12 months ago, focus is on economic growth tempered by concerns that NI tax hikes may weaken hiring and wage growth. Agency staffing needs has varied widely across different sectors, in October it was reported London is set to reclaim a staggering 48% of banking vacancies. New job postings within the Pensions industry have remained consistent, reflecting the shortages of talent, the need to train newcomers to the industry and upskill existing staff. We speak daily with companies actively hiring, with well-practised virtual interviewing and onboarding processes and increased flexible working patterns now widely available from fully remote to hybrid. In a continuing candidate-driven market career opportunity, benefits packages, flexibility and a nimble recruitment process are essential to attract and retain talented individuals.

As an industry, Pensions attracts individuals who will have a structured career path across their working life, and equally individuals who may take a more varied path including those who move into this field mid or later career.

Here are just a few of the career paths this industry offers at the entry/junior level:

There are a number of career paths open to you, depending in part of the structure of the training and development scheme you undertake, for example if you are qualifying as a lawyer, an actuary or an accountant (to name but a few) and also the areas of the industry that are of interest to you, for example working in consultancy or for an in-house Pensions department, or if you are interested in specialising in certain areas such as administration, project management, IT, communications, investments or accounts (just a few examples of the numerous areas this industry offers opportunities in).

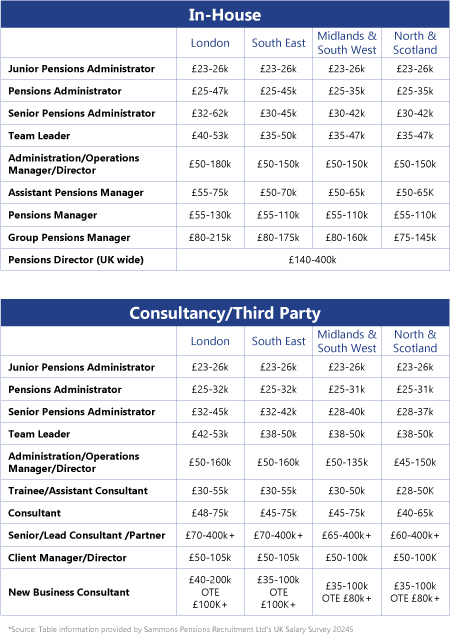

For entry level candidates, the most typical route into Pensions would be Trainee Pensions Administrator positions. Salaries for this level vary, but there is no doubt that with the right support and driven attitude, and commitment to attaining professional qualifications, with salary increases often following each exam passed, there is no limit to how quickly this can increase. These salaries do align very similarly from In-house to Consultancy/Third Party, with little difference at this level.

Congratulations, you have been rewarded for your hard work and now have been promoted! Salaries across Pensions/Senior Pensions Administrators have seen the largest overhaul in the last couple of years, partly inflation driven, but also by employers recognising the lack of available talent in the market at this level, both in-house and in third-party/consultancy.

Longer-term career paths could include management through to Operations Director or moving into more specialist roles such as project management, client relationship management, consulting, or in-house scheme management to name but a few.

Top trends for recruitment in 2025: Huge shifts in employment rights and workplace practices will bring both challenges and opportunities, including embracing AI to navigating compliance complexities and redefining work arrangements. Employers will need to be prepared for increased compliance complexities due to rapidly changing regulations, with Labour’s Employment Bill of Rights potentially changing sick leave and maternity leave policies, rules around redundancy and dismissals, and flexible work legislation, in turn supporting commitment to DEI. While many employers believe a mandated return to the office will increase productivity, employees want flexible work arrangements. Allowing working patterns to promote individual productivity and employee satisfaction, will decrease risk of losing employees or loss of productivity. New flexible working rights will give all employees the default right to request and access flexible work, all employers will technically be ‘open to flexible work’.

Pensions industry latest developments: Industry experts are expecting a busy year for the pensions industry in 2025, predicting increased demand in the pension risk transfer market, growing momentum around pensions dashboards, and key changes to the advice/guidance boundary.

This is an industry that never stops evolving to meet these demands, attracting, and retaining talented, innovative, and passionate individuals, by offering long-term and rewarding careers where you can feel that you have made a difference.